The Permanent Portfolio allocation is 25% stocks, 25% bonds, 25% gold and 25% cash. In this series of posts we're going to talk about how to implement each one of these components to take advantage of the economic cycles of Prosperity, Inflation, Recession and Deflation.

This FAQ is divided into two sections: Short Answers and Long Expanded Answers. If you don't want to know the details then just read the Short section and skip the Long Expanded section. This page will be updated from time to time as more common questions and answers are needed.

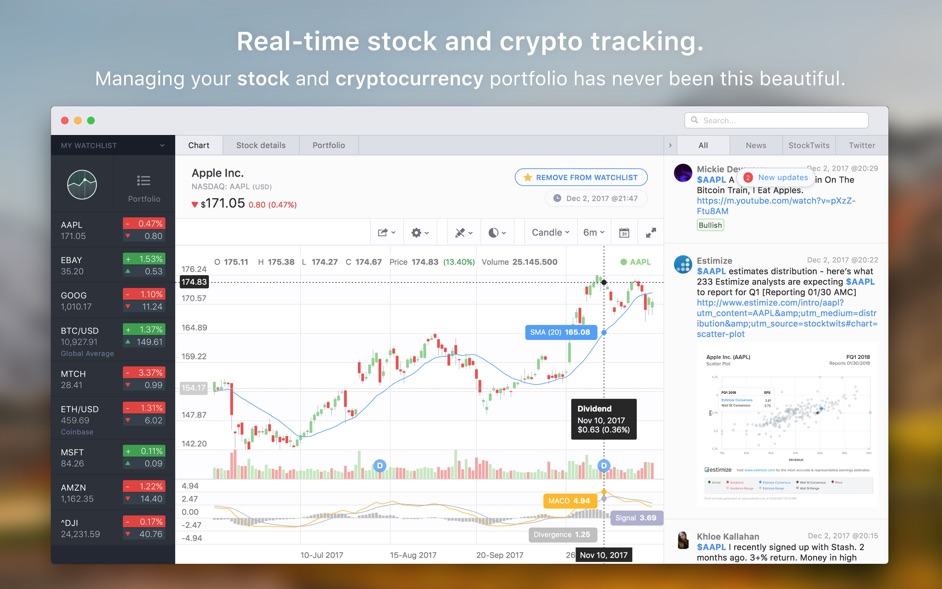

NOTE: As Yahoo updated their finance API to v10, there is currently some issues retrieving the data, Stockfolio is depending on yahoo-finance as data provider and people are working to get the module functional.

- The operator of Primo's Mexican Restaurant paid $1.52 million for the building, equipment and land that includes an ample parking lot and a patio.

- 192.168.1.52 router login and password for your device at 192.168.1.52 We will help you get into your router or other devices on your network 192.168.1.52 is a private ip address used for local networks.

We begin this series with discussing the 25% stock allocation and Prosperity. Mac game joe danger 2: the movie.

Why own stocks for Prosperity?

Stocks are the #1 asset to have during times of prosperity. During these times the economy is sound and growing. Inflation is under control (less than 5% per annum) and not causing any rapidly rising prices. Market interest rates will be stable and perhaps slightly falling. People are happy.

In prosperity it is not uncommon to see stock prices rise sharply as companies grow, expand and produce profits for investors. Annual stock returns (price increase + dividends) could be in the +-10% historic range. Times are good, employment is stable, people are spending money on products and services. Stocks are going to perform well.

What kind of stocks should I own in the Permanent Portfolio?

You should own a broad-based stock index fund that captures the maximum returns offered by the stock market without trying to beat the market with speculative stock bets.

That means you want to use a stock index fund and only a stock index fund.

Why is an index fund the best choice for the Permanent Portfolio?

Because index funds are the average of the entire stock market. It represents the average returns an investor could expect that year without trying to beat the market. Over time it has been shown that index funds will beat almost all actively managed funds.

What stock index fund should I use?

There are many index funds available today. Some are good, some are mediocre and some are downright bad. You want to own the cheapest and most broadly-based stock fund available. That leaves two main choices:

- Standard & Poors (S&P) 500 Index

- Total Stock Market Index

What index fund should I buy?

Here are the basic considerations:

- It should track the S&P 500 or Total Stock Market Index

- It should have an expense ratio below 0.50% a year

- It should be a passive index with no active management of the fund

- It should be from a well-established company with a track record for index investing

- It must be 100% invested in stocks at all times no matter what.

Here are some options that fit the above criteria:

S&P 500 Index

Total Stock Market Index

This list is far from complete. If you are at a brokerage or mutual fund company that offers their own index fund then you can use that as long as it meets the listed criteria.

* See question below about difference between an Exchange Traded Fund (ETF) and a Mutual Fund.

Should I use the S&P 500 or Total Stock Market index if I have the choice?

I prefer the Total Stock Market for the wider diversification and tax efficiency. Harry Browne suggested using the S&P 500. It doesn't matter too much for performance except for some small amount.

Can I use an actively traded fund for the Permanent Portfolio instead of a broad based index fund?

No you can't. You don't want a fund manager making decisions to move between stocks, bonds, cash, commodities, etc. and disturbing the strategy. You must use a fund that is 100% invested in stocks at all times for the stock portion of the portfolio. The Permanent Portfolio holds assets that will protect you from big stock losses already. You don't need a manager trying to out-guess the markets.

This rule is not flexible. Do not break it.

My retirement plan doesn't offer any index funds. What can I do?

This is an unfortunate problem for many workers. Index funds are not as profitable for mutual fund companies who like making big fees on actively managed funds. As a result, many 401(k) and IRA plans don't offer index funds.

In this case you have few choices:

1) Move your IRA to someplace like Vanguard that has index funds.

2) Ask your retirement plan administrator to make index funds available either by requesting them from the 401(k) custodian or if necessary moving the company 401(k) plan to a new custodian that does offer them.

3) Use the funds that you have to the best of your ability.

If you are forced into option (3) (and many are), then try to look for the following in your funds that you do have:

- Lowest expense ratio possible.

- Should track the broadest and largest stocks in the US market.

- Should be 100% in stocks at all times and not be moving in and out of assets like bonds.

- Should have low portfolio turnover.

What about owning International stocks and what index should I use?

International exposure is not so important to US investors. The US Economy and companies are already all over the world. There is also currency risk with international stock investing which can hurt performance in some cases. However, if you wanted to own some international exposure then perhaps 5% or so of the portfolio is fine (so 20% US index and 5% Intl. Index).

Again the international index should be cheap and broad-based. The EAFE international index, FTSE international ex-US index or what is sometimes called a Total International Index are good choices:

Harry Browne did not openly advocate international diversification in the Permanent Portfolio, but his associates have said a little is OK. Also, some international index funds charge slightly more because of the added expense of trading on foreign stock exchanges. Therefore, international stock index funds are more expensive but should not exceed 0.75% in expense ratio.

What's the recap?

- Only buy index funds for the stock portion of the portfolio.

- The index fund should be either Total Stock Market or the S&P 500.

- The index fund expense ratio should be less than 0.50% a year (unless it is an international index and can be up to 0.75% a year).

- Never purchase an actively traded stock fund unless you have absolutely no other choice available to you.

- Do not try to beat the market with the funds. Your market protection is already built into the other asset classes you own. The stock asset class serves a specific purpose and you don't want to tamper with it by trying to outguess the market.

- If you want to own some international exposure you should limit it to about 5% allocation (5% Intl + 20% Domestic = 25% total in stock)

What is a stock index fund?

An index fund is a way of passively tracking a pre-defined basket of stocks. Index funds typically own several hundred to several thousand company stocks. These stocks are usually owned in proportion to the size of the company in the market. For instance an index fund owning the US Stock market will own a much larger number of shares of General Electric (a huge multi-national company) compared to small regional publicly traded company like a power utility.

The advantage of this approach is the index doesn't need to engage in expensive activities associated with actively traded investment funds (such as research, analysts, advisors, etc.). Because the stock index fund owns the entire market it is expected to earn the average performance of the market in any one year minus their small management fees to maintain the fund.

What is the S&P 500 Index?

The S&P 500 is an index of stocks compiled by Standard and Poor's that comprise the 500 largest and most liquid publicly traded companies in the United States by market capitalization. These are the companies you rely on every day of your life for just about everything you do. General Electric. Wal-Mart, 3M, Microsoft, Johnson and Johnson, Google, Coca-Cola, IBM, Home Depot, McDonald's, etc.

You can see the entire current list here:

The S&P 500 represents around 70% of the total value of the US Stock market.

What is the Total Stock Market Index?

The Total Stock Market (TSM) index includes all the companies of the S&P 500, but also includes all the other publicly traded companies that aren't quite big enough to make it into the largest 500 list. These are called 'mid-cap' and 'small-cap' companies which means they have a market capitalization (size) that is smaller than the biggest (which are called 'large-cap').

The TSM index is commonly called other names such as the Wilshire 5000 or Russell 3000. A TSM index commonly holds thousands of companies (3000-7000+) in the composition as opposed to the 500 of the S&P 500. The TSM index easily covers 98%+ of the entire US publicly traded stock market. This is why it's called the 'Total Stock Market' Index. It owns just about everything except tiny low-volume stocks or penny stocks.

Why should I only use index funds for the Permanent Portfolio?

Indexing is the best and most efficient way to invest in stocks. Not only does it guarantee you maximum possible returns because you own all the companies all the time, but it's also cheap. A typical index fund may have an expense ratio of less than 0.20% per year. This means for every $10,000 you have invested in the index the fund management company is going to take just $20 for handling all the operations.

Compare this to a non-index fund which can charge 1%, 2% or more each year. It doesn't sound like much, but for each $10,000 invested you're paying $100, $200 or more every year to the managers. Over the years it starts to really add up and hurt performance. It's like driving a car dragging an anchor behind it where the index is like driving that car dragging just an empty soda can.

Not only this, but most actively managed funds don't beat the index fund over time. So you are paying more in management fees and you're paying this extra cost for them to underperform the market. Yes, it's true.

Didn't Harry Browne recommend owning the S&P 500 Index in his book Fail-Safe Investing and radio show? Why use the Total Stock Market Index instead?

It doesn't matter that much except maybe for taxable investors. The Vanguard S&P 500 index has been available for 30 years and was the world's first commercially successful index fund. It has a stellar track record.

In the early 1990's though the Total Stock Market came on the scene. It held a much larger number of stocks and should have slightly better tax efficiency. The overall performance between the two is largely identical depending from year to year. Over the past several years, companies like Vanguard (the pioneer in index funds and world's largest fund company) are recommending to their customers to use the Total Stock Market fund over the S&P 500 fund.

The reason why I personally prefer the TSM over the S&P 500 is the wider diversification and tax friendliness.The S&P 500 index holds 500 stocks and sometimes when a company shrinks it is removed from the index and replaced with a new one. This can generate unnecessary selling for the fund and those costs are passed onto the fund holders. If you are holding the fund in a taxable account this means you could incur capital gains taxes that you didn't expect.

Because the TSM owns almost all publicly traded stocks at all times it tends to generate less capital gains vs. the S&P 500 because it isn't required to sell a company when it gets too small and buy more of another when it gets too big. If a company gets too small in the TSM it is probably bankrupt and will be delisted. This is not a taxable event. Likewise if a company gets too big there is no need for the index to sell another company to make room for the new leader. The fund simply buys more of the new leader's stock.

With the above said, we're dancing on the head of a pin. Both types of index funds are quite tax-efficient and offer excellent performance. I simply prefer the TSM fund because I like the wider diversification and want to get any edge on tax efficiency I can. If you want to use the S&P 500 index, or have no other choice, then that is still an excellent decision and you will be in great shape for the Permanent Portfolio strategy. Don't sweat it.

Shouldn't I have a fund manager making stock decisions using their wisdom and insight?

NO! First of all the Permanent Portfolio has fixed allocation to stocks, bonds, cash and gold. You don't want to own a fund for your stock portion and have that manager suddenly decide they don't want to own stocks and go 100% cash or bonds. They can throw a real monkey wrench into the strategy if you have not only the markets moving around but now you have some fund manager trying to outguess what is going to happen next.

The Permanent Portfolio strategy has assets that will cover you if the markets are doing poorly or doing well. You don't need a fund manager making decisions that could hurt performance.

But aren't fund managers smarter than me at beating the market?

You aren't trying to beat the market. Also, here's a secret: Fund managers are the market.

Somewhere around 90% of all stock trades on the market are between institutional investors. That means mutual fund companies, pension plans, endowments, stock brokers, investment banks, etc. They are basically all trading against each other. Each has access to the same information, the same real-time news, the same hot tips, etc. Yet, one has decided to buy a stock and one has decided to sell that same stock.

What does this mean? It means they are both trading on virtually identical information and making decisions that are 180 degrees away from each other. How can that be? Simple: They are trading on random noise.

When you own the entire stock market you benefit from all the wisdom, research and money these other firms have spent analyzing the stocks of the companies in the index. The index holds all stocks. The stocks go up and down as earning outlooks adjust. You just sit back and collect the money without having to pay a bunch of MBAs to research everything and come to opposite conclusions about what to do. It's the best deal going.

But can't a good manager beat the market?

It's no better than luck. Virtually every study performed on this area has shown it to be luck. It's called the Random Walk because the market movements are equivalent to a drunk stumbling down the street. You can watch him and know he's moving a particular direction, but at any moment he may change course, stumble, reverse or simply puke on your shoes. It's not predictable and one of the core tenants of the Permanent Portfolio is not trying to predict the markets.

The important thing to remember is that each year the people who beat the market changes. One year you'll have a hot fund manager and the next year they may rank near the bottom. Then a new winner will come up to beat the index only to find in a couple years they've faded away. And on and on.

Well as it turns out, over time as winners come and go the average annual return of the index funds just keeps climbing and climbing higher. After a decade or two the index fund owners find that their returns end up in the top quartile of performance without having to pay high fees to get it.

Think of it this way. Let's say you're a marathon runner in a group of 10 people. You're not the fastest, but you have consistent performance and finish in the top half of all participants each time you race. Sometimes you're 5th, sometimes 3rd, sometimes 4th, etc.

Now you enter a series of races against your nine competitors and you run each year for 20 years. Over that time the fastest runner the first year ends up dead last the next. The previous loser is now the winner. Then a new winner shows up and hurts his knee and drops out of racing entirely due to the injury. Etc. The years go by and you never win a race, but you're consistent. You're so consistent that you've racked up many 5th place, 4th place, 3rd place and maybe even a couple 2nd place finishes. You've never done really well each year, but you've also never done really badly. In fact you've managed to show up for each and every race and never missed one yet.

Well after 20 years of this consistent performance you will probably find that you've won the marathon series. Your rivals have either dropped out, burned out, or were never consistent enough to be in the top five. Your supposedly 'average' performance pushed you into the well above average category because you are so consistent and reliable year in and year out.

That's indexing. You're not going to be the best each year, but over time you're going to win. Promise.

What is a fair expense ratio for an index fund?

Anything 0.50% a year or below for a US index fund or 0.75% or below for an International fund.

Some companies offer S&P or Total Stock Market funds with outrageously high expense ratios of 1% or more. Do not use these funds unless you have no other choice available. If the index fund is charging more than 0.50% a year then you are being charged too much and need to find another option if you can.

Some international index funds charge slightly more because of the added expense of trading on foreign stock exchanges. Therefore, international stock index funds are more expensive but should not exceed 0.75% in expense ratio.

If your only choice is an expensive index fund or an expensive actively managed fund then choose the expensive index fund. The best choice though is a cheap index fund.

What is the difference between a Mutual Fund and an ETF?

An ETF is short for Exchange Traded Fund. This is a fund that can be traded intraday like any stock on the market. You can buy an ETF in the morning and sell it at lunch then buy it back again before you go home from work. This would be an incredibly bad idea, but you could do it if you wanted.

A typical mutual fund however allows redemptions and deposits on a fixed basis (usually at the end of the trading day). This means when you buy a fund you get the price of the fund after the market closes. You can't trade in and out of it multiple times a day. Coolorus 1 3 1. Some companies (like Vanguard) won't even let you buy back into a fund you just sold until you wait 60 days. This is done to keep the market timers and performance chasers from hurting the long-term holders of the fund and keep down costs.

The difference here doesn't matter much for a buy-and-hold investment strategy like the Permanent Portfolio. The hourly or even daily fluctuations in price are irrelevant. However there is one major difference between ETFs and Mutual funds: Trading Costs.

When you buy a mutual fund you send your money to the your broker or fund custodian and make the purchase. Many times if the mutual fund is with the same company there is no transaction fee for this. You would, for example, send your money into Vanguard and tell them 'Buy as many shares of the Total Stock Market Index as my deposit allows.' They say 'Ok.' The sale is made, and the shares deposited into your account with no other fees involved.

Well with an ETF you need to deal with a brokerage. You have to place a market order, perhaps worry about a bid/ask spread, then pay a commission on the whole transaction. The commissions at a discount broker can be less than $10 or be hundreds of dollars at a 'full-service' brokerage for each trade.

The problem is if you are making many small trades then the ETF can get expensive. If you are, for instance, depositing $100 a month into your portfolio you may spend $10 just to purchase the ETF. In other words, 10% of your savings that month went into transaction costs! Not good.

However if you sent that same $100 into a mutual fund company they simply would buy into the fund and not charge you commission. So you save money on the upfront purchase. Much better.

Now there are times where ETFs make sense and I will recommend some ETFs later on. But the important thing to remember is you should do the transactions in bulk and not a bunch of small trades with ETFs. If you follow that rule you can avoid the small commission charges that can really add up over time.

What about using an index fund that tracks a specialty index like small-cap stocks?

This is not advised. You want the broadest based index fund that captures the widest returns available from the US Stock market. That means the S&P 500 or TSM funds.

But haven't small-cap stocks beaten large-cap stocks over the years?

Stockfolio 1 52 Inch

Academics say 'yes'. Reality says 'it depends'. There are periods of time when large-cap companies dominate the market returns and times when small-cap companies dominate the market returns. It is unpredictable.

Let's look at a big stock bull market to make our point. From 1980-1999 Small Cap stocks returned 14.29% CAGR but Large Cap stocks returned 17.11% CAGR. So for nearly 20 years the supposed higher returns of small-cap stocks over large-cap stocks didn't exist. That's a long time to wait for a theory of small-cap outperformance to show up isn't it? How many people would have been sticking with that idea by year 17 or 18 of the strategy? Not many.

A broad based index will ensure you can grab extra returns from any stock asset class because you'll own all of them all the time.

And before you start thinking that you'd rather have 100% stock portfolio to get those great returns all I can say is 'Good Luck!' That was a wild ride and one of the greatest bull markets in stocks in US history. Not only that, but there are periods on both sides of that date range (1970's and 2000's) when stock performance was horrible!

Stockfolio 1 52 Sailboat

If you still need more information about why the small cap advantage may not be that big of an advantage after all, please see this speech by Vanguard Founder Jack Bogle:

What about owning some international stocks?

Harry Browne didn't advise this specifically. John Chandler, a close associate of Harry Browne and his former publisher says a little International exposure is OK but don't go overboard.

My opinion is that 20% of your stock allocation percentage in International stocks is fine. That means 5% of your 25% allocation could be international stocks (5% – Intl and 20% Domestic).

The US is still about half the world's economic output. It's simply massive and not going away any time soon despite what some say. The fact is that American companies already have huge international presence and therefore international exposure already. Think about it and you'll agree. General Electric has appliances, lightbulbs, generators, jet engines, etc. all over the world. You can't hardly go anywhere on the planet without running into a McDonald's or Starbucks. Microsoft and Apple Computer sell their products everywhere. Don't forget food either. Archer Daniels Midland, Kraft, Campbells Soup, Coca-Cola, etc. export their products extensively. Caterpillar sells their construction equipment to everyone to build roads, bridges, buildings and everything else. Finally, you probably are flying on a Boeing plane to get to all of these places and rent a Ford or GM car to go to your Marriott hotel when you get there. Did you forget your running shoes for your morning jog? Not a problem. The store down the street probably sells Nikes.

Get my point?

So even if you think you have 0% international exposure by only owning American companies you actually don't. It's almost certain that the profits you receive from these stocks are generated from all over the world and not just from America.

What's the recap?

- Only buy index funds for the stock portion of the portfolio.

- The index fund should be either Total Stock Market or the S&P 500.

- The index fund expense ratio should be less than 0.50% a year (unless it is an international index and can be up to 0.75% a year).

- Never purchase an actively traded stock fund unless you have absolutely no other choice available to you.

- Do not try to beat the market with the funds. Your market protection is already built into the other asset classes you own. The stock asset class serves a specific purpose and you don't want to tamper with it by trying to outguess the market.

- If you want to own some international exposure you should limit it to about 5% allocation (5% Intl + 20% Domestic = 25% total in stock)

Building a portfolio requires a lot of patience, planning and critical thinking to cover all bases and ensure you have exposure to all aspects of the economy, while also having adequate diversification without being overexposed to any one industry.

Depending on your level of funds you have to invest, each investor will have the ability to have different position sizes and number of stocks in the portfolio. However, even with just a five-stock portfolio, you can start to build up a core portion of your holdings, which you can expand in the future as you save more money.

Stockfolio 1 52 Percent

These five stocks are some of the best companies in Canada that will give you exposure to growth, income, value and some defence.

Suncor Energy Inc (TSX:SU)(NYSE:SU)

When investing in Canadian stocks, you need to have some energy stocks, as so much of our economy and the TSX is composed of energy companies. If you can pick just one energy stock, it should be Suncor.

Suncor is the best integrated energy stock, and in these times of uncertainty in the oil markets and issues with takeaway capacity in Western Canada, having refining and retail operations is a huge saviour.

It pays a dividend that's highly sustainable and yields roughly 4% today.

BCE Inc (TSX:BCE)(NYSE:BCE)

BCE will give you a solid core stock and a blue chip to own for your portfolio. The company operates in an industry that has become a necessity to our way of life. Given that it's the largest telecom in Canada with some of the best operations, it should definitely be included as a core pillar of your portfolio.

It still has a long path of growth ahead of it as we move to 5G and as Canada's wireless network becomes more saturated.

The stock also pays a dividend yielding just under 5% that's increased often.

goeasy Ltd. (TSX:GSY)

Smooze 1 1 25 – rediscover your mouse. goeasy has been a great growth stock over the last few years, especially since it shifted the focus of its business more on consumer lending and less on furniture financing.

Its return on equity is roughly 25% for the trailing 12 months; in the last three years, the stock is up more than 180%.

Given its commitment to grow its loan book value and the fact the company's market cap is still just under $1 billion, there's no reason why the growth should slow down.

Algonquin Power & Utilities Corp. (TSX:AQN)(NYSE:AQN)

Algonquin is a great stock to hold, especially if your funds means that you have limited stocks in which to invest. The company owns utilities that will add defence to your portfolio, but it also owns renewable energy assets, one of the best growth industries.

The company is well managed with a strong balance sheet. Currently, Algonquin pays out a dividend yielding roughly 4.1%.

Equinox Gold Corp (TSXV:EQX)

Equinox — or any other top gold stock for that matter — will be the perfect hedge for your portfolio. You should always hold at least some gold exposure in your portfolio, and given where we are in the market cycle, now is the time to increase that exposure.

Equinox is the perfect stock because it's an up-and-coming gold miner that just started production in 2018. It still has another mine in development, which is expected to come online in the third quarter of 2020.

Its operations today are still impressive, however, with production in 2019 expected to be over 200,000 ounces and at strong all-in sales costs of just roughly $950.

Bottom line

As much as having exposure to a number of industries matters, so too does having exposure to income, value and growth stocks.

These categories don't always perform equally, which is why diversification in the strategies you use could be key to capturing more profits long-term.

This sample portfolio gives you an ideal example of all the different investing strategies while diversifying across industries. It's designed to cover all basis with just five stocks, and equal weighting across the board would yield an investor roughly 3% on the portfolio while still giving you tonnes of growth exposure and protecting your capital.

Motley Fool Canada's market-beating team of experts has just released a brand-new FREE report revealing 5 'dirt cheap' stocks that you can buy today.

Our team thinks these 5 stocks are critically undervalued right now, but more importantly, they could potentially make Canadian investors who act quickly a fortune.

Don't miss out! Simply click the link below to grab your free copy and discover all 5 of these stocks now.

More reading

Fool contributor Daniel Da Costa owns shares of Equinox Gold. and SUNCOR ENERGY INC.